Fri January 19, 2018

Truck and Trailer Guide

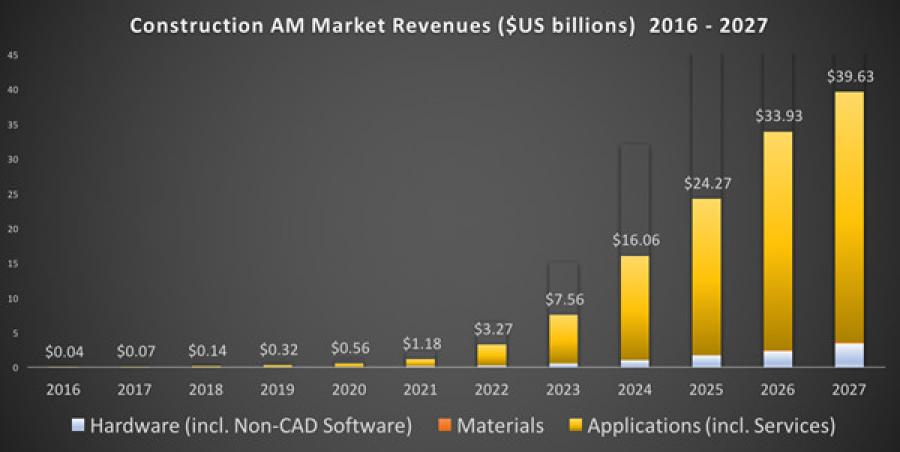

SmarTech Publishing has just issued a new report that examines the market potential for additive manufacturing in the construction industry. SmarTech expects the market for 3D printing in construction to top $40 billion in revenues by the end of the 10 year forecast period.

In this new report, SmarTech outlines all the major technologies, hardware, materials and applications that will usher the traditional construction industry into a new, digitalized era. The report goes on to identify and quantify the specific commercial opportunities presented by implementation of AM technologies in terms of hardware, materials, software and AM construction services associated demand and revenues. According to the report, this activity is expected to grow into a $4 billion yearly business opportunity for hardware manufacturers and a highly profitable segment for construction material producers that choose to add digital manufacturing services to their core business.

Further details of this report can be found at: https://www.smartechpublishing.com/reports/digitalizing-the-construction-industry-with-additive-manufacturing-a-ten-ye

About the Report:

The construction industry could represent as large an opportunity for additive manufacturing as the entire industrial and medical manufacturing industries combined. While the technology is still young, billion-dollar deals have already been signed, bringing these technologies intro futuristic construction projects worldwide. As technologies progress and the industry rapidly expands, some of the largest construction groups are investing to secure know-how and advance the development of new materials and processes.

Truck and Trailer Equipment

Truck and Trailer Equipment Articles

Articles Sign up for Updates

Sign up for Updates Sell Your Machines

Sell Your Machines

Truck and Trailer Equipment

Truck and Trailer Equipment Truck and Trailer Dealers

Truck and Trailer Dealers Truck and Trailer Articles

Truck and Trailer Articles Sign up for Updates

Sign up for Updates Sell Your Machines

Sell Your Machines